Effective with the December 16, 2023 pay period, SGMC Health will be increasing the PTO accrual rate for employees. The PTO sell back practice will also change effective June 1, 2024.

Who is eligible for Paid Time Off (PTO)?

SGMC Health provides vacation, sick, and holidays in a combination plan called Paid Time Off (PTO). This time is granted as a reward for diligent service and for you to enjoy rest and relaxation.

This benefit is available to be used as it accrues, but it should be requested in advance.

You may accrue up to a maximum of 500 hours of Paid Time Off. To request or donate PTO, refer to the employee handbook or PTO policy on the HUB.

Eligibility: An employee must be a benefit eligible full-time or part-time employee and work at least 40 hours per pay period. PTO accrual begins with the first day of employment or following a transfer from a non-benefit eligible position to a benefit-eligible position.

How is PTO Accrued?

Regular/Full Time Employee:

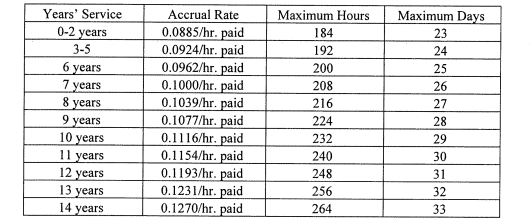

A regular/full time employee is one who consistently works a minimum of 30 hours in a normal workweek. Full time employees (40 hr/wk) earn PTO at a rate of 23 days (184 hours) per year. This time off includes eleven (11) vacation days, seven (7) holidays, and five (5) sick days for each of the first two (2) years of continuous employment.

PTO accrues on paid hours up to a maximum of 80 hours per pay period. The above figures show Paid Time Off benefits for a regular full time employee who is paid 80 hours each and every pay period.

Each full time employee is encouraged to take a minimum of one week’s Paid Time Off each year and time taken must be in increments of one hour.

What is Compassionate Leave

An employee who wishes to take time off due to the death of a family member should notify his or her supervisor immediately.

Compassionate Leave will normally be granted unless there are unusual business needs or staffing requirements. An employee may, with supervisor approval, use any available vacation for additional time off as necessary.

Compassionate Leave pay is calculated based on the base pay rate at the time of absence It will not include any special forms of compensation, such as incentives, commissions, bonuses, overtime or shift differentials.

Paid Compassionate Leave will be granted as follows:

- Employees are allowed up to three consecutive days off from regularly scheduled duty with regular pay in the event of the death of the employee’s spouse, co-parent, child, father, father-in-law, mother, mother-in-law, son-in-law, daughter-in-law, brother, sister, stepfather, stepmother, stepbrother, stepsister, stepson or stepdaughter. To be eligible for paid bereavement leave, the employee generally must attend the funeral of the deceased relative.

- Employees are allowed two consecutive days off from regular scheduled duty with regular pay in the event of death of the employee’s brother-in-law, sister-in-law, grandparent, grandchild, spouse’s grandparent, niece or nephew. To be eligible for paid bereavement leave, the employee generally must attend the funeral of the deceased relative.

- Employees are allowed one consecutive day off from regular scheduled duty with regular pay in the event of death of the employee’s aunt, uncle or first cousin. To be eligible for paid bereavement leave, the employee generally must attend the funeral of the deceased relative.

- If it is necessary for the employee to be absent more than the allotted days for travel or related business affairs, accrued Paid Time Off (PTO) or leave without pay may be taken provided that prior approval is obtained from the Department Director. Time off should be contiguous with the date of death or funeral.

Use of PTO (Vacation, Sick Leave, or Holidays)

Vacation:

PTO to be used as vacation time or a holiday should be requested well in advance of the desired time off in order for managers to adjust schedules accordingly. While mangers try to grant time off as requested, the nature of our business does not always permit such time to be approved exactly as requested.

It is understood that family situations, emergencies, and numerous other occurrences cause employees to need and/or want to use PTO. When an employee is faced with such a situation, he or she should contact his/her supervisor as EARLY AS IS POSSIBLE to request PTO. Managers and supervisors understand that these situations occur and do their best to grant these requests, however, it must be understood that the needs of the hospital are managers’ first responsibility. Occasionally some give and take on the part of both the employee requesting the time off and the manager must take place before approval is ultimately granted.

It is not acceptable for an employee to request PTO on short notice by email, voice mail, or by sending a message by a family member or another employee. Only in the most extenuating of circumstances will approval of PTO be granted in this manner.

Sick Leave:

Paid Time Off may be requested by employees who miss work because of illness or the illness of a child, spouse or parent. When the need to take PTO because of illness arises, it is required that the employee notify their manager in accordance with any applicable departmental policies in order to be paid for the time off. Employees who call in sick before a regularly scheduled shift are required to use PTO for the full shift (8, 10, 12, 24 hours or the number of hours equivalent to their regular shift) provided they have such an amount available. Those employees who have sick leave remaining from the plan which was in effect prior to October 4, 2003, may elect to use time from this bank or from their PTO bank.

Employees whose date of employment occurred prior to October 4, 2003, may maintain their sick leave accrual from that plan until they leave the organization, however there will be no further accrual to that plan. Those employees who have time remaining in that plan may request payment for time missed due to illness from that plan. The call in process as referenced in paragraph E must be followed. Whatever remains will be paid upon resignation or retirement to those who leave the organization in good standing. No amount of this sick leave may be cashed in.

Sick leave may be used in increments of one (1) hour but not in fractions of an hour unless depleting the bank.

Holidays:

New Year’s Day, Memorial Day, Independence Day, Labor Day, Thanksgiving and Christmas Day are the holidays observed by SGMC Health. The plan also includes one “floating holiday.” Employees in departments, which close on those days, must request a PTO day on the closed holiday if they wish to be paid for the holiday. Employees must secure advance approval from supervision before taking PTO. Employees will not be allowed to have a negative balance.

Non-exempt employees eligible for benefits who are scheduled to work on the holidays listed above will receive pay at the rate of 1% times their regular hourly rate.

Holiday observance will begin at 11:00 p.m. the night before the holiday and end at 11:00 p.m. the night of the holiday.

Recognized Holidays:

– New Year’s Day

– Memorial Day

– Fourth of July

– Labor Day

– Thanksgiving Day

– Christmas Day

Use of Paid Time Off When Going On A Leave of Absence:

An employee may elect to or SGMC may require that an employee use accrued time while on FMLA or other leaves of absence.

Payment of Paid Time Off (PTO):

Paid Time Off is paid at the employee’s regular base rate of pay. At the time of taking Paid Time Off, the pay shall not include any shift differential.

Payment of available Paid Time Off (PTO):

Employees who receive PTO benefits, including 7on/7off staff, may cash in up to 40 hours of PTO and all accrued hours over 160 in a calendar year. PTO must be cashed in with minimum increments of 8 hours.

Employees on disciplinary suspension will NOT be permitted to cash in PTO or Sick Leave or any other hours for the pay period during which the suspension occurs. If the suspension should cross pay periods, benefit time may not be cashed in for either of the two pay periods.

Employees who accumulate PTO benefits will receive pay for all accrued PTO at separation provided appropriate notice is given and the employee leaves in good standing.

Employees who do not provide the required notice at separation or who are terminated for cause forfeit their entitlement to accumulated PTO benefits.

If an employee terminates employment with SGMC Health and has a negative balance in their PTO bank due to a PTO advance, their final paycheck will be reduced accordingly.

Transfers- Employees, who transfer from a benefit status to a non-benefit status, will be paid for any accrued PTO benefits at the time of transfer.

PTO may be used in increments of one (1) hour but not in fractions of an hour unless depleting the bank.

PTO is not accrued on Paid Time Off submitted for payment when cashing in PTO.

Time Off Without Pay:

Time Off without pay may occasionally be requested. Approval is at the discretion of Department Managers.

Donation of PTO

Employees may donate a portion of their accumulated PTO hours to aid another employee who is unable to work due to a personal illness or crisis.

The potential recipient employee must be benefit eligible, have completed his/her introductory period, and not be eligible for disability pay. Further, the potential recipient must have exhausted all of his/her PTO, Sick Leave and Attendance Bonus.

The potential recipient employee must prepare a written request for donated PTO for his/her Department Manager who will verify that the requesting employee has no available PTO, Attendance Bonus, or Sick Leave. (See Forms Page)

The donor employee must indicate in writing the name of the employee to whom the donation is being made, along with the number of hours being donated, and submit the request to the Director of Human Resources or his designee. The donor employee must maintain a balance of at least eighty (80) hours of PTO. The minimum donation is four (4) hours of PTO.

The manager of the recipient employee, in concert with the Human Resources Director, will submit to Payroll the appropriate documentation for payment of the donated PTO hours to the named recipient employee. The cash value of donated hours will be calculated and administered at the equivalent hourly pay rate of the recipient employee.

Employees may not solicit others for PTO donations.

Donations of PTO will be accepted only at such time as a request has been made.

For all other PTO related inquiries please see Policy PPP 07