Your need for life insurance varies with your age and financial responsibilities. Life insurance helps you bridge the gap between the financial needs of your dependents and the finances that would be available to them from other resources.

Basic Life Insurance with MetLife

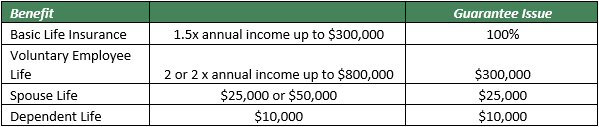

SGMC offers a Basic Life Insurance plan for the employee equal to 1 & 1/2 your annual salary that is at no cost to the employee. To be eligible for the Basic Life Insurance, you must be a benefit-eligible employee and you must have completed your benefits enrollment eligibility period (1st of the month following 30 days of employment). The coverage is guaranteed issue for all benefit-eligible employees with a $300,000 maximum benefit.

Supplemental Life Insurance with MetLife

Supplemental Life Insurance is designed to give employees the option to have additional life insurance coverage beyond the covered amount with Basic Life Insurance. Employees must be benefit-eligible and must have completed their benefits enrollment eligibility period (1st of the month following 30 days of employment). Supplemental Life Insurance provides coverage equal to 1 or 2 times the employee’s annual salary and is available with or without AD&D (Accidental Death & Dismemberment). To apply, you may be required to complete an Evidence of Insurability (EOI) before coverage and premiums will begin.

Child Life Insurance with MetLife

Group Term Life Insurance is available for the employee to purchase on their children and legal dependents. Child Life Insurance will cover each child for a $10,000 benefit amount. Children can be covered up to age 26 and must primarily supported by the employe. Whether you have 1 children or 5, you only pay one small monthly premium for Child Life Insurance.

Spouse Life Insurance with MetLife

SGMC offers two levels of Group Term Life Insurance for an employee’s spouse. Coverage level options are $25,000 or $50,000. To apply, you may be required to complete an Evidence of Insurability (EOI) before coverage and premiums will begin.