Health/Rx coverage is offered to all full-time, benefit eligible employees. SGMC Health offers a self-insured group health insurance plan through Trustmark (the TPA) which utilizes the Blue Cross Blue Shield network.

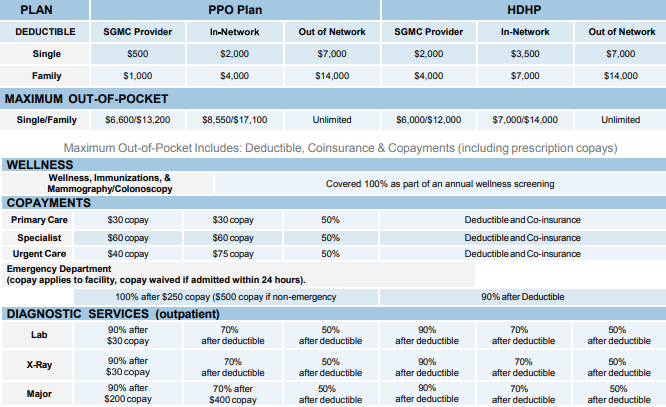

SGMC Health currently offers two plan options to our benefit-eligible employees. The first plan is built around a domestic copay plan. SGMC Health is the Domestic Provider of benefits, and we encourage you to use our facilities and providers in order to get the best pricing available through the Domestic Network. “In-Network” providers, also known as Tier 2 providers, will be provided through Blue Cross Blue Shield, whose network includes a vast range of physicians and offices all over the country. You also have the option of a Flexible Spending Account with the PPO.

The second option is the High Deductible Health Plan or HDHP. The High Deductible option offers lower premiums but higher out of pocket expenses as well as the opportunity to contribute pre-tax funds to a Health Savings Account, or HSA. For eligible employees who enroll in the HDHP option, SGMC Health will pre-fund $500 for employee only plans and $1,000 for employees with insured dependents/spouses.

Refer to the Health Savings Account and Flexible Spending Account tabs on the right for more information.

To locate a list of domestics providers, utilize SGMC Health’s “Find a Physician” tool and look for physicians with the green SGMC +.

What is a PPO?

A Preferred Provider Organization (PPO) is a plan that includes a network. By using a network provider, you receive a greater benefit than by using a non-network provider. Our network is the United Healthcare Options PPO and includes a vast range of physicians and offices all over the country. A PPO has a medium-range premium and a medium-range deductible with co-payments to assist in the cost of doctor’s office visits. You also have the option of a Flexible Spending Account with the PPO.

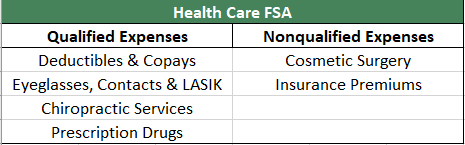

What is a Flexible Spending Account (FSA)?

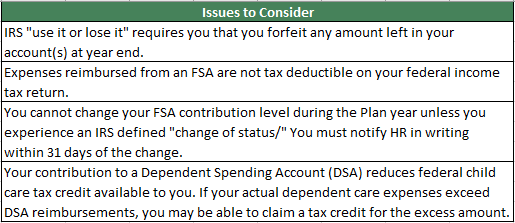

A Flexible Spending Account is an account you put money into that you use to pay for certain out-of-pocket health care costs. During Open Enrollment, you elect the amount of money you would like to place in your FSA, which comes from pre-tax deductions bi-weekly. The IRS determines the maximum amount for the FSA’s. You will receive an FSA card, which functions much like a debit card, and you can use that card for any medical related expenses, including doctor’s office visits, prescriptions, dental costs, or vision costs. Please Note: Flexible Spending Accounts do not roll over year-to-year.”

SGMC Health offers Flexible Spending Accounts (FSA) administered by Trustmark for all benefit eligible employees. When you establish an FSA, you set aside pretax dollars to pay for certain expenses. This reduces your taxable income and you can request reimbursement as you incur eligible expenses. Refer to IRS Publication 502, “Medical & Dental Expenses” for a complete list of qualified expenses.

Flexible spending tools available to you through Trustmark will include a FSA/HRA mobile app (ability to file a claim, submit receipts using mobile device camera) and portal access.