SGMC offers Flexible Spending Accounts (FSA) administered by Trustmark for all benefit eligible employees. When you establish an FSA, you set aside pretax dollars to pay for certain expenses. This reduces your taxable income and you can request reimbursement as you incur eligible expenses.

Flexible spending tools available to you through Trustmark will include a FSA/HRA mobile app (ability to file a claim, submit receipts using mobile device camera) and portal access.

There are 2 types of Flexible Spending Accounts:

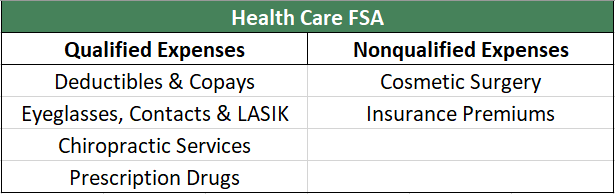

| Health Care Flexible Spending Account | Dependent Care Spending Account |

|---|---|

| Helps you pay expenses that are not covered by your medical, pharmacy, dental, or vision plans. | Helps you pay expenses incurred for having someone care for your dependent(s) while you work. |

When you establish a flexible spending account, you are setting money aside to pay for certain expenses before the money is taxed. You may also request reimbursement as you incur eligible expenses.

Flex Filing Deadlines

- While the plan year is from January 1st to December 31st each year, there is a 2 and 1/2 month grace period in which you may continue to use your Flexible Spending Account.

- Deadline to incur claims from your FSA is March 15th. For example, you have a Flexible Spending Account for plan year 2013; you may file claims for any dates of service on your FSA from January 1, 2014 until March 15, 2014.

- The deadline to file on all claims incurred between January 1st of the plan year through March 15th of the following year is March 31st following the end of the grace period on March 15th. Any unused funds in your FSA after March 31st will be forfeited by the employee as required by federal law.

MORE INFORMATION

A Medical Flexible Spending Account and a Dependent Care Spending Account are accounts set up for you to set aside pre-tax dollars on a bi-weekly basis to help pay your healthcare expenses that are eligible under the IRS code or daycare expenses. The benefit of using either of these accounts is that you do not pay federal and state income taxes or Social Security taxes on the money that goes into the account. This lowers your taxable income.

IT’S IMPORTANT TO NOTE…

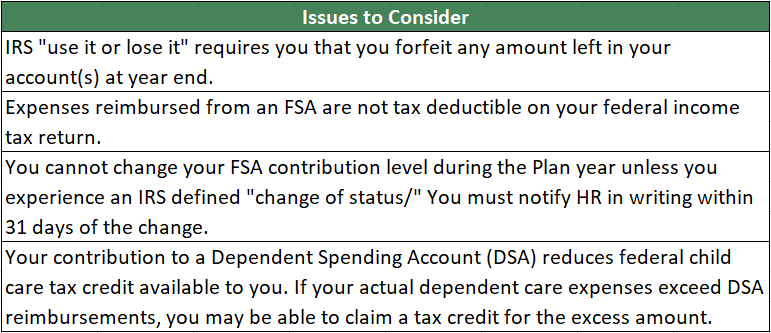

– If you are using pre-tax dollars to reimburse yourself for out-of-pocket medical or daycare expenses, you cannot claim those expenses as a deduction on your annual income tax.

– Flexible Spending Accounts must be used for expenses incurred during the plan year.

– If you do not use the money when the plan year is over, you lose it. Flexible Spending Account dollars do not roll over into the next year.